News

2021 Press releases

P&F Industries, Inc.

Joseph A. Molino, Jr.

Chief Operating Officer

631-694-9800

www.pfina.com

Joseph A. Molino, Jr.

Chief Operating Officer

631-694-9800

www.pfina.com

P&F INDUSTRIES, INC. REPORTS RESULTS FOR THE YEAR ENDED DECEMBER 31, 2020

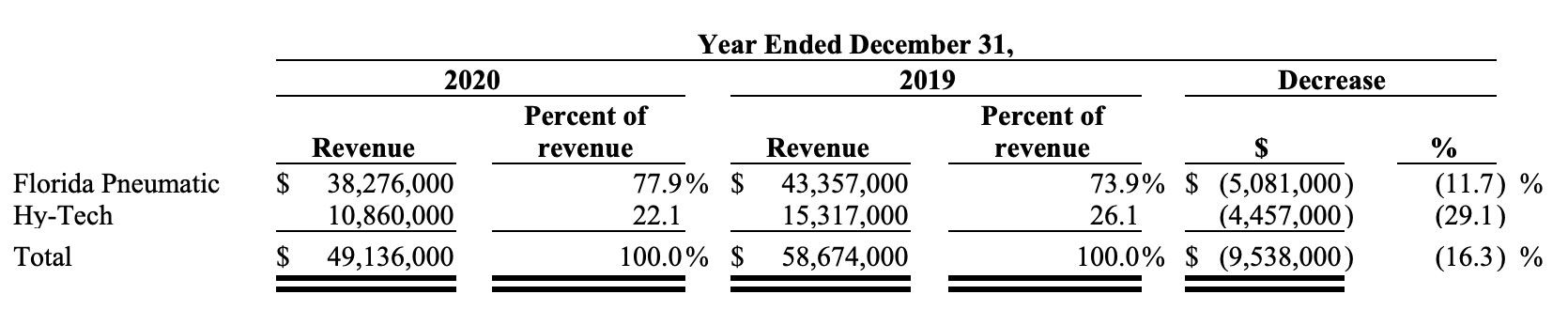

MELVILLE, N.Y., March 25, 2021 - P&F Industries, Inc. (NASDAQ: PFIN) today announced its results from operations for the year ended December 31, 2020. The Company is reporting net revenue of $49,136,000, compared to $58,674,000, reported in 2019. Additionally, the Company is reporting a 2020 loss before income taxes of $6,855,000, compared to income before income taxes of $6,708,000 in 2019. Included in the current year’s loss before income taxes was an impairment charge of $1,612,000, while 2019’s income before income taxes included a $7,817,000 gain realized from the sale of the Company’s Jupiter, Florida facility. After giving effect to income taxes, the Company is reporting for 2020 a net loss of $4,954,000, compared to net income of $4,911,000 for 2019.

Richard Horowitz, the Company’s Chairman of the Board, Chief Executive Officer and President commented, “Our revenue and net results for 2020 were greatly affected by several factors, the most significant of which is the ongoing negative impact of the global COVID-19 pandemic. Additionally, we encountered extreme weakness in the aerospace sectors in which we do business. Specifically, during 2020 the Boeing Company severely limited the production of its 737 MAX aircraft. This was exacerbated by reduced production of military and other commercial aircraft throughout the industry. These factors caused a significant decline in our aerospace revenue. In addition, the downturn in global oil and gas exploration and production activity resulted in lower related revenue, compared to 2019. With lower sales, our production was reduced, in turn resulting in weak manufacturing absorption at our manufacturing facilities, which severely affected our overall gross margin. In an effort to lessen the impact of lower margins, we reduced our selling, and general administrative expenses by nearly $2,500,000. Finally, during 2020 we recorded impairment charges of $1,612,000.”

Mr. Horowitz continued, “On a more positive note, as the United States is beginning to show initial signs of recovery from the harsh effects that COVID-19 had brought upon us, we, in turn, are currently beginning to see modest signs of improvement. During the first two months of 2021, we have witnessed increases in overall customer order activity, compared to levels achieved during the latter half of 2020. Additionally, our ability this year to visit current and prospective customers has improved compared to 2020. Specifically, our Power Transmission Group, or PTG has witnessed an increase in order and sales activity during the first two months of 2021, compared to their average levels incurred in 2020. Lastly, Boeing has restarted its manufacture of their 737 MAX aircraft, as well as announcing increases in other aircraft production. We believe this ramp up in their activity, combined with increasing air travel, should generate revenue opportunities at Jiffy and Florida Pneumatic.”

Mr. Horowitz added, “We remain optimistic about sales opportunities in Europe. However, all were put on some form of hold during 2020, due to the global pandemic. With several key European countries still in some form of lockdown, combined with the sluggish rates of vaccination, we believe it is likely these opportunities may not begin to materialize, if at all, until the second half of 2021.”

Mr. Horowitz concluded his remarks with, “We continue our product development across the Company’s businesses. In addition, we expect to further expand our Engineered Solutions business and PTG, through the pursuit of new applications, customers, and markets, both in the United States and Europe. We remain confident that when this pandemic subsides, we will be well positioned to take advantage of the economic recovery. We remain focused on being a key provider and developer of power hand tools and accessories. In addition, as the Company has previously announced, it received a $2.9 million Payroll Protection Program loan in April of 2020. We have submitted our application for forgiveness of this loan and believe we have met all criteria necessary to have most, if not all, of it forgiven. Further, we believe we have access to ample capital under our credit facility. We will continue to serve our customer’s needs, while also ensuring the health and safety of our employees. Finally, I wish to thank and recognize the incredible work our employees have done to navigate through these unprecedented times.”

The Company will be reporting the following:

TRENDS AND UNCERTAINTIES

COVID-19 PANDEMIC

On March 11, 2020, the World Health Organization designated the recent novel coronavirus, or COVID-19, as a global pandemic. COVID-19 was first detected in Wuhan City, Hubei Province, China and continued to spread, significantly impacting various markets around the world, including the United States. Various policies and initiatives have been implemented to reduce the global transmission of COVID-19.

For a portion of 2020, the COVID-19 pandemic impacted our ability to source certain of our products, particularly with respect to factories that we utilize located in China and Italy; however, we do not believe that this is likely to have a material negative impact on our results for the foreseeable future.

The impact of the COVID-19 virus and the resultant global economic down-turn has had a material impact on our results during 2020. In March 2020, nearly all of the United States, United Kingdom and much of Europe, had ordered non-essential businesses to stop physical operations and ordered its residents to remain home or “shelter-in-place” in order to attempt to control the impact of this pandemic. In addition, many businesses are restricting visits from vendors thus impeding demand. Fortunately, we were able to continue our operations at all of our facilities. While these controls were lifted in the United Sates and many countries abroad, a number of major European nations and the United Kingdom reinstated “lock-downs” in late 2020 and early 2021. We believe that until this pandemic subsides, where hospitalizations and deaths have declined significantly, it is likely our results will continue to be negatively affected.

BOEING/AEROSPACE

The Federal Aviation Administration (“FAA”) and the European Union Aviation Safety Agency (“EASA”) have lifted the grounding of the 737 MAX. However, production is still very limited due to the inventory at Boeing and the reluctance of airlines to accept deliveries due to weak air travel demand. This will likely continue to have an adverse effect on our revenue. In addition, production of military and other commercial aircraft throughout the industry has slowed as well due to the ongoing global COVID-19 pandemic. However, we believe when all other commercial and military production lines throughout the United States come back online, an increase in our revenue should follow.

OIL AND GAS

We believe the primary factor contributing to the significant decline occurring in early 2020 in the price of oil worldwide was the COVID-19 pandemic. The profitability of crude oil production generally declines as prices fall. As a result, as prices dropped in 2020, production slowed dramatically worldwide. This activity is most easily measured by analyzing the number of active rotary rigs. The number of active rotary oil rigs according to Baker Hughes, Inc. as of December 31, 2020, has declined by approximately 60% or more, from a year ago. Additionally, while not as large a market for our products, the natural gas rig count is down approximately 34% when comparing the data for same two dates. Until these counts return to pre-pandemic levels, we will continue to be impacted negatively.

TECHNOLOGIES

We believe that over time, several newer technologies and features will have a greater impact on the market for our traditional pneumatic tool offerings. The impact of this evolution has been felt initially by the advent of advanced cordless operated hand tools in the automotive aftermarket. We continue to perform a cost-benefit analysis of developing or incorporating more advanced technologies in our tool platforms.

RESULTS OF OPERATIONS

2020 compared to 2019

REVENUE

The tables set forth below provide an analysis of our revenue for the years ended December 31, 2020 and 2019.

Consolidated

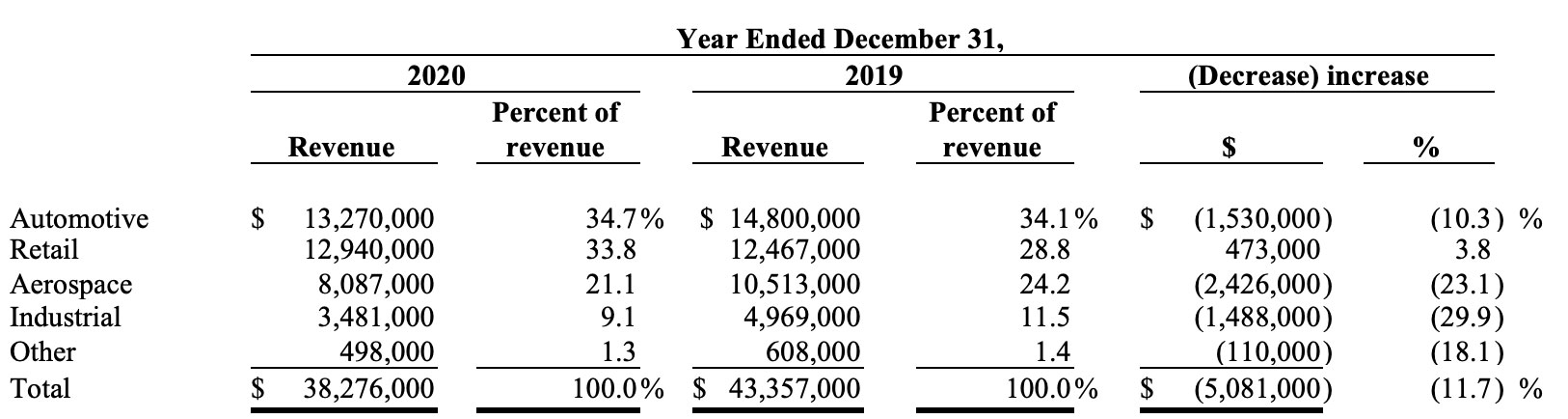

Florida Pneumatic

Florida Pneumatic markets its air tool products to four primary sectors within the pneumatic tool market; Retail, Automotive, Aerospace, and Industrial. It also generates revenue from its Berkley products line, as well as a line of air filters and other OEM parts (“Other”).

The Boeing Corporation is a major customer of Jiffy. The continued grounding and minimal production of Boeing’s 737 MAX and reduced production of other Boeing aircraft was the major factor driving the decline in Florida Pneumatic’s 2020 revenue, when compared to 2019 revenue. Additionally, we believe that the limited air travel caused by the COVID-19 pandemic forced many of our other aircraft customers to reduce their 2020 order levels. Further, military aircraft production declined, we believe due to constraints placed in manufacturing facilities caused by the pandemic. Although the FAA has recently lifted the “No Fly” ruling it imposed on all Boeing 737 MAX aircraft, recently allowing it to begin flights in the United States, we believe it will take several months for the Boeing Corporation to increase its manufacturing of its 737 MAX aircraft to a volume that will require our Jiffy tools. Our Industrial product line has also encountered lower revenue this year, compared to 2019, due primarily to the business interruptions caused by global effects of the COVID-19 pandemic, as our ability to travel has resulted in little to no direct interaction with current or prospective customers. Automotive revenue also declined when comparing full year 2020 and 2019 results.

The key drivers to this decline were weak sales at our U.K. operations, which in turn was due we believe to limited travel caused by the pandemic, and the loss of a major distributor in the U.S. A portion of this decline was offset with higher gross margin sales to other distributors. After an increase in Retail revenue during the first quarter of 2020, the pandemic adversely affected revenue during the second quarter of 2020, then improved again during the last six months of 2020. The improvement that occurred during the second half of 2020 was driven primarily from the sale of spray guns (used to apply anti-viral and anti-bacterial solution) and, to a lesser extent, growth in other pneumatic tools.

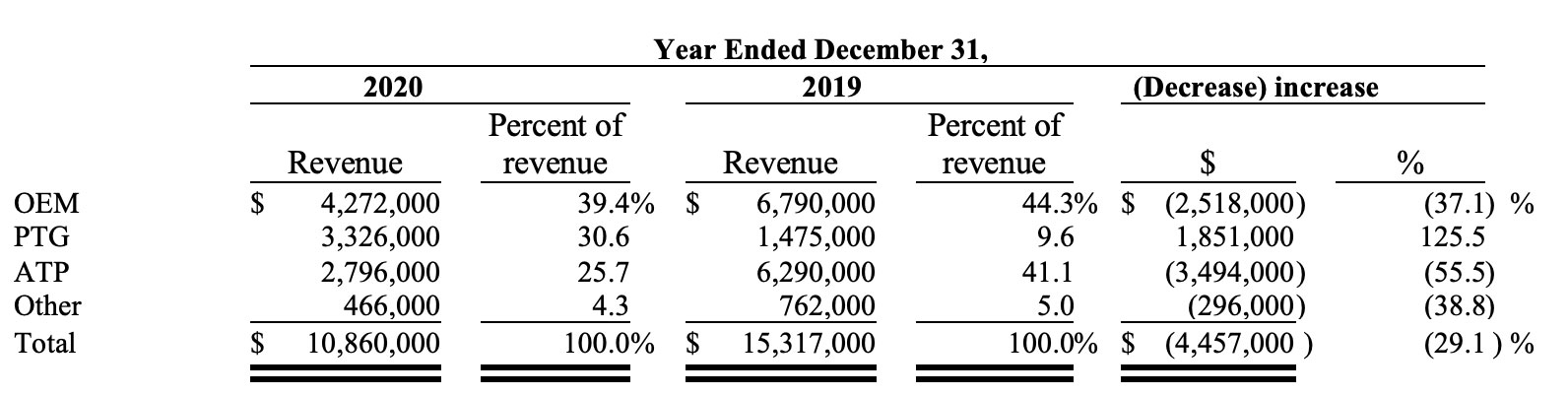

Hy-Tech

Hy-Tech designs, manufactures, and sells a wide range of industrial products under the brands ATP and ATSCO which are categorized as ATP for reporting purposes. In addition to Engineered Solutions, products and components manufactured for other companies under their brands are included in the OEM category in the table below. Power Transmission Group (“PTG”) revenue is comprised of products manufactured and sold by the gear businesses that were acquired in October 2019, products sold through Hy-Tech’s legacy gear manufacturing division and products sold to a certain customer whose revenue was included in OEM in 2019. NUMATX, Thaxton and other peripheral product lines, such as general machining, are reported as Other.

The decline in Hy-Tech’s total net revenue for the fiscal year 2020, compared to 2019, was primarily due to the following key factors: the global COVID-19 pandemic; the severe downturn of the oil and gas market, and certain key customers that were in inventory over-stock positions and unable or unwilling to place orders during 2020, at similar levels to 2019. Additionally, our OEM revenue was adversely affected by significant declines in orders during the third quarter of 2020, compared to the same period in 2019, from a major customer that services the aerospace market, which as discussed elsewhere, encountered weak demand for new aircraft. Specifically, we believe that our ATP products offering is likely to continue to struggle due to among other things, the ongoing sluggishness of the price of oil and natural gas, which in turn inhibits exploration and drilling. The oil and gas sector in the United States has been hindered by the downward pricing pressure caused by among other things, excess supply, and ripple effects from the pandemic. This is evidenced by the significant decline in drilling rigs, which is a metric that we monitor. According to Baker Hughes Inc., the average number of rotary rigs in operation during 2020 were 433, compared to 943 during 2019. As such, early in 2020 we made a decision to focus a greater portion of our product development and marketing efforts on our Engineered Solutions and to a lesser extent PTG products offering. We believe the development of the Engineered Solutions and PTG product offerings should provide Hy-Tech an opportunity to generate new, additional sources of revenue in the future. Additionally, we believe that the inability to travel, due to restrictions put in place as the result of the pandemic, greatly reduced direct interaction with current and potential customers was a significant factor in the decline in revenue in all product categories, particularly OEM. Further, as noted above, certain OEM customers who were active in 2019, did not place orders in 2020. Partially offsetting the above, our PTG line, driven by the acquisition in late 2019, saw its revenue improve. However, the transition and relocation from their former Illinois locations to our facility in Punxsutawney Pennsylvania and the ongoing negative effects of the COVID-19 pandemic, resulted in lower than projected PTG revenue and profits during 2020. Reductions in staff, marketing and product development are the key factors in the reduction on Hy-Tech’s Other lines.

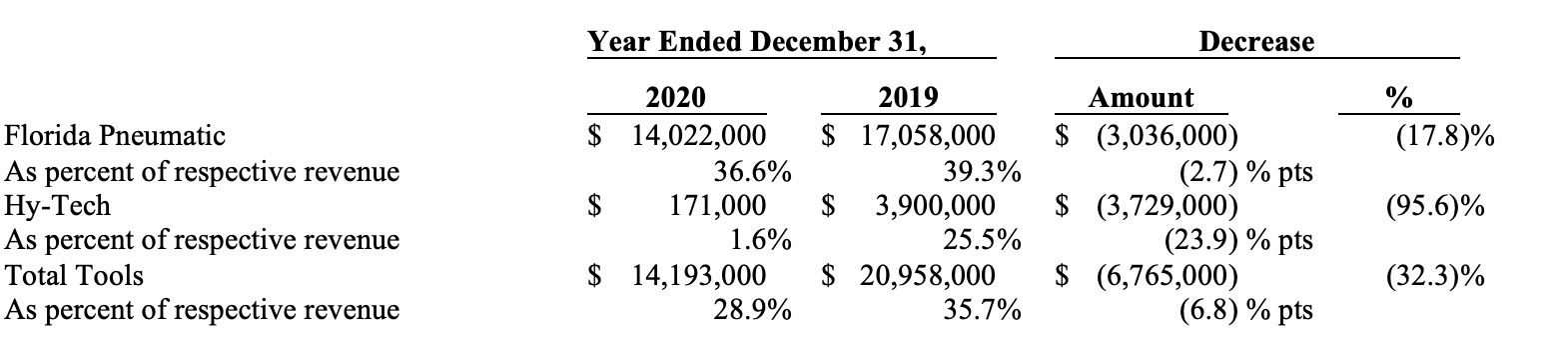

GROSS MARGIN

A significant factor causing the 2.7 percentage point decline in Florida Pneumatic’s gross margin is the under absorption of manufacturing overhead at Jiffy, due to lower Aerospace revenue, which as discussed earlier was due to travel and visitation restrictions caused by the COVID-19 pandemic and the halt in production of Boeing’s 737 MAX aircraft and other commercial and military sales. Additionally, its gross margin declined due to product/customer mix. Specifically, there was a nearly 30 percent decline in Industrial and Automotive revenue sectors when comparing 2020 to 2019, both of which have higher gross margin than other product lines, compounded with an increase in Retail revenue, which tends to generate lower gross margin.

The decline in Hy-Tech’s gross margin was the result of several factors. We believe this significant decline was directly corelated to the global pandemic and economic down turn. With major travel constraints imposed due to the COVID-19 global pandemic, Hy-Tech’s revenue was greatly impacted, which lead to Hy-Tech encountering a reduction in machine hours, which resulted in significant under absorption of their manufacturing overhead. Specifically, when comparing full year 2020 to 2019, total machine hours declined approximately 35%. Hy-Tech’s total gross margin was also negatively impacted by the general mix of products sold during the year. During the second quarter of 2020, Hy-Tech recorded an unfavorable physical inventory adjustment. Additionally, it incurred an increase in charges relating to obsolete, slow moving inventory, (“OSMI”) which also negatively impacted Hy-Tech’s overall gross margin. Further, primarily occurring during the first half of 2020, Hy-Tech’s total gross margin was impacted by lower than expected gross margin on the sale of PTG products, due primarily to start-up issues in the new facility during this period. Lastly, Hy-Tech incurred increased duty charges on certain imported parts and increased costs incurred from outside vendors due to smaller batch sizes for certain manufacturing processes.

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

Selling, general and administrative expenses (“SG&A”) include salaries and related costs, commissions, travel, administrative facilities, communications costs and promotional expenses for our direct sales and marketing staff, administrative and executive salaries, and related benefits, legal, accounting, and other professional fees as well as general corporate overhead and certain engineering expenses.

Our SG&A during 2020 declined to $19,367,000, from $21,869,000 in 2019. A significant component of the net decrease of approximately $2.5 million was a reduction of $1,434,000 in compensation expenses, which is comprised of base salaries and wages, accrued performance-based bonus incentives and associated payroll taxes and employee benefits. The elimination of 2020 corporate bonuses, and to a much lesser extent, staff reductions and significant reductions of subsidiary bonuses also contributed to the reduction in our 2020 SG&A. Additionally, our variable expenses, which consist of operating costs such as travel and entertainment, commission, warranty, advertising, and freight out, decreased $956,000, primarily due to travel and business constraints caused by the COVID-19 pandemic. Additionally, non-cash impairment charges that were reported in 2019 did not reoccur in 2020, thus resulting in a $221,00 expense reduction. Depreciation and general corporate expenses declined $128,000 and $81,000, respectively. The decrease in depreciation was due primarily to the sale in 2019 of the Jupiter, Florida facility. Partially offsetting the above decreases was an increase of $237,000 in professional fees and consulting costs. The relocation of the gear businesses during the first and second quarters of 2020 and temporary staffing were the primary factors. Lastly, our rent expense increased $55,000, as Florida Pneumatic now rents a portion of the facility it sold.

GOODWILL AND INTANGIBLE ASSETS IMPAIRMENT

During the second quarter of 2020, we recorded goodwill and intangible asset impairment charges totaling $1,612,000, with $284,000 related to goodwill and $1,328,000 related to customer relationships, patents, and trade name.

OTHER INCOME

In connection with the Gears Acquisition, there was the possibility that we could pay additional consideration (“contingent consideration”) to the sellers if certain inventory components were sold during the two-year period commencing on the date of acquisition. At the time of the acquisition we believed, based on a range of possible outcomes, that it was more likely than not, that items within this inventory group would be sold, and accordingly included in the purchase price a contingent consideration obligation of $64,000. In January 2021, we and the sellers agreed to settle this obligation for $12,000. As such, we reduced the contingent consideration payable by $52,000 and recorded a like amount as Other Income.

During 2020 we received grants totaling $53,000 at our United Kingdom operation from Her Majesty’s Government, which is not required to be repaid.

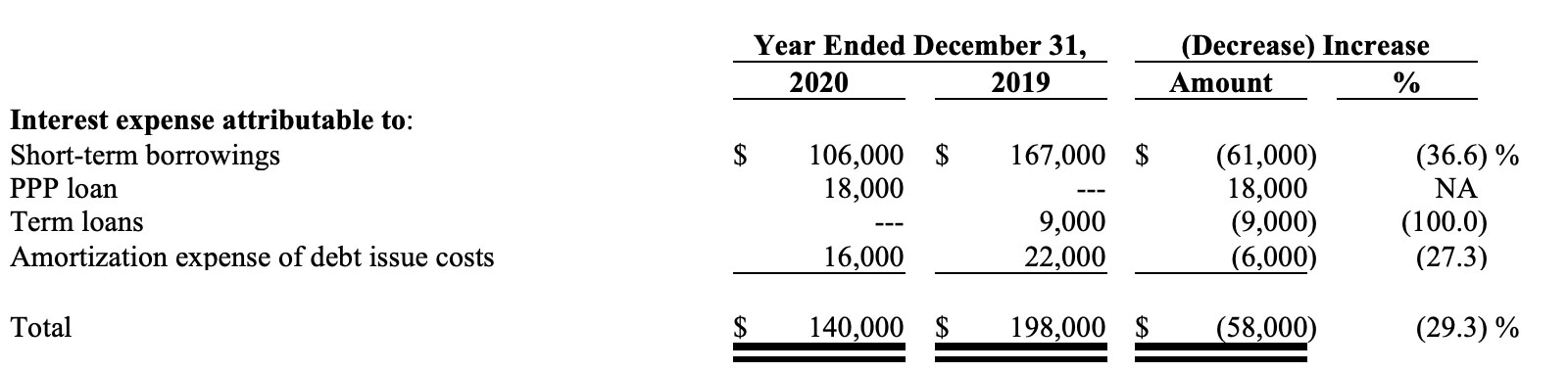

INTEREST EXPENSE – NET

The reduction in short-term borrowings interest expense was due primarily to lower average borrowings in 2020, compared to the average borrowing levels in the prior year. The reduction in short-term borrowings were driven by reduced inventory and accounts receivable levels. As we have not received forgiveness from the Small Business Administration relating to our PPP loan we accrued $18,000. The Term loan interest in 2019 related to a loan that was fully paid during 2019. Lastly, we and our bank amended the Credit Agreement in February 2019. The debt issue costs associated with such amendment, are significantly lower than the costs associated with the expiring Credit Agreement. As such, the amortization of debt issue costs during 2020 declined compared to the prior year.

INCOME TAX EXPENSE

The 2020 provision for income taxes was a benefit of $1,901,000 compared to a tax expense of $1,797,000 in 2019. Significant factors impacting 2020’s net effective tax benefit rate of 27.7% were the enactment of the Coronavirus Aid, Relief, and Economic Security Act, non-deductible permanent differences, state and local taxes. The net effective tax rate for 2019 was 26.8%.

LIQUIDITY AND CAPITAL RESOURCES

We monitor such metrics as days’ sales outstanding, inventory requirements, accounts payable and capital expenditures to project liquidity needs, as well as evaluate return on assets. Our primary sources of funds are operating cash flows and our Revolver Loan (“Revolver”) with our bank.

We gauge our liquidity and financial stability by various measurements, some of which are shown in the following table:

Credit facility

We have a credit facility with Capital One bank, N.A., which provides the ability to borrow funds under a $16,000,000 revolver line (“Revolver”), subject to certain borrowing base criteria. Additionally, there is a $2,000,000 line for capital expenditures (“Capex Loan”), with $1,600,000 available for future borrowings. Revolver and Capex Loan borrowings are secured by our accounts receivable, inventory, equipment, and real property, among other things. The Credit facility expires on February 8, 2024. This credit facility is discussed further in our previously filed Quarterly Reports on Form 10-Q.

The average balance of short-term borrowings during the years ended December 31, 2020 and 2019 were $4,042,000 and $4,253,000, respectively.

We believe that should a need arise whereby the current credit facility is insufficient; we can obtain additional funds based on the value of our real property.

Payroll Protection Program Loan (“PPP”)

On April 20, 2020, we received a $2.9 million PPP loan, as provided pursuant to the CARES Act. This loan was obtained from BNB Bank is unsecured and is guaranteed by the SBA.

Cash Flows

At December 31, 2020, cash provided by operating activities for the year was $3,047,000, compared to cash used in operating activities for the year ended December 31, 2019 of $2,514,000. At December 31, 2020, our cash balance was $904,000, compared to $380,000 at December 31, 2019. Cash at our UAT subsidiary at December 31, 2020 and 2019 was $335,000 and $85,000, respectively. We operate under the terms and conditions of the Credit Agreement. As a result, all domestic cash receipts are remitted to Capital One lockboxes.

Our total debt to total book capitalization (total debt divided by total debt plus equity) at December 31, 2020 was 9.4%, compared to 10.8% at December 31, 2019.

We believe as a result of operations and working capital needs due to anticipated growth, we will likely be required to increase our borrowings from our Revolver during 2021.

Capital spending during the year ended December 31, 2020 was $1,104,000, compared to $1,524,000 in 2019. Capital expenditures currently planned for 2021 are approximately $1,100,000, which we expect will be financed through the Credit Facility. The major portion of these planned capital expenditures will be for new metal cutting equipment, tooling and information technology hardware and software.

On February 11, 2020, our Board of Directors, in accordance with its dividend policy, declared a quarterly cash dividend of $0.05 per common share, which was paid on February 28, 2020, to shareholders of record at the close of business on February 24, 2020. The total amount of this dividend payment was approximately $157,000. Additionally, our Board of Directors did not issue any further dividends in 2020. As relates to declarations and payments of dividends in the future, the Board of Directors will continue to monitor several factors, which includes such things as our overall financial condition, results of operations, capital requirements and other factors our board may deem relevant.

At December 31, 2020, we had $8,530,000 of open purchase order commitments, compared to $4,871,000 at December 31, 2019.

Customer concentration

At December 31, 2020, The Home Depot (“THD”) accounted for 26.3% of our consolidated revenue, compared to 20.7% of 2019’s revenue. Further, accounts receivable at December 31, 2020 and 2019 from THD were 38.0% and 27.2%, respectively. There was no other customer that accounted for more than 10% of revenue or accounts receivable in 2020 or 2019.

IMPACT OF INFLATION

We believe that the effects of changing prices and inflation on our consolidated financial position and our results of operations have been minimal.

OTHER INFORMATION

P&F Industries Inc. has scheduled a conference call for March 25, 2021 , at 11:00 A.M., Eastern Time, to discuss its fiscal year of 2020’s results and financial condition. Investors and other interested parties who wish to listen to or participate can call 1-866-337-5532. It is suggested you call at least 10 minutes prior to the call commencement. For those who cannot listen to the live broadcast, a replay of the call will also be available on the Company’s website beginning on or about March 26, 2021.

FORWARD LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 (the “Reform Act”) provides a safe harbor for forward-looking statements made by or on behalf of P&F Industries, Inc. and subsidiaries (“P&F”, or the “Company”). P&F and its representatives may, from time to time, make written or verbal forward-looking statements, including statements contained in the Company’s filings with the Securities and Exchange Commission and in its reports to shareholders. Generally, the inclusion of the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “will,” “may,” “would,” “could,” “should” and their opposites and similar expressions identify statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and that are intended to come within the safe harbor protection provided by those sections. Any forward-looking statements contained herein, including those related to the Company’s future performance, are based upon the Company’s historical performance and on current plans, estimates and expectations. All forward-looking statements involve risks and uncertainties. These risks and uncertainties could cause the Company’s actual results for all or part the 2021 fiscal year and beyond to differ materially from those expressed in any forward-looking statement made by or on behalf of the Company for a number of reasons including, but not limited to:

- Risks related to the global outbreak of COVID-19 and other public health crises;

- Exposure to fluctuations in energy prices;

- Debt and debt service requirements;

- Borrowing and compliance with covenants under our credit facility;

- Disruption in the global capital and credit markets;

- The strength of the retail economy in the United States and abroad;

- Risks associated with sourcing from overseas;

- Importation delays;

- Risks associated with Brexit;

- Customer concentration;

- Adverse changes in currency exchange rates;

- Impairment of long-lived assets and goodwill;

- Unforeseen inventory adjustments or changes in purchasing patterns;

- Market acceptance of products;

- Competition;

- Price reductions;

- Interest rates;

- Litigation and insurance;

- Retention of key personnel;

- Acquisition of businesses;

- Regulatory environment;

- The threat of terrorism and related political instability and economic uncertainty, and

- Information technology system failures and attacks,

and those other risks and uncertainties described in the Company’s most recent Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q, and its other reports and statements filed by the Company with the Securities and Exchange Commission. Forward-looking statements speak only as of the date on which they are made. The Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. The Company cautions you against relying on any of these forward-looking statements.

CONSOLIDATED BALANCE SHEET (PDF)

P&F Industires, Inc. make available forms & documents which are available for download. These forms & documents are in Adobe® PDF (portable document file) format. In order to view these forms & documents, you must have Adobe® Acrobat® 7 Reader. If you don't have the reader, you can download it for free from Adobe® by clicking here or on the "Get Acrobat® Reader" icon below.